The Power of a Daily Budget: Simplifying Your Finances

Managing finances can be overwhelming, but a daily budget simplifies it. This method involves setting a daily spending limit and tracking expenses as they occur, using an app or spreadsheet. Tracking daily will help you break the cycle of impulse purchases and thus improve your financial health.

Managing your finances can be daunting, but it doesn't have to be. The daily budget approach is one simple and effective tool to help you better understand your spending and reduce unnecessary expenses.

The standard recommendation does not stand up to practice

The typical tip you usually read is to keep a budget book, where you define a budget for regular monthly expenses, e.g. 250,- € for groceries. However, I find that monthly budgets don't help influence my day-by-day decisions.

They are good if you want to evaluate them at the month's end. And then you can see if you are over or under. But the defined budget and the consequence of exceeding it are too abstract for everyday decisions.

What is a Daily Budget?

A daily budget is a method to track your spending daily rather than monthly or yearly. This approach allows you to see exactly where your money is going and identify areas where you may be able to cut back on expenses.

The Daily Budget is a blend of 'Digital Minimalism' and the 80/20 pareto principle, applied to personal finances.

How Does it Work?

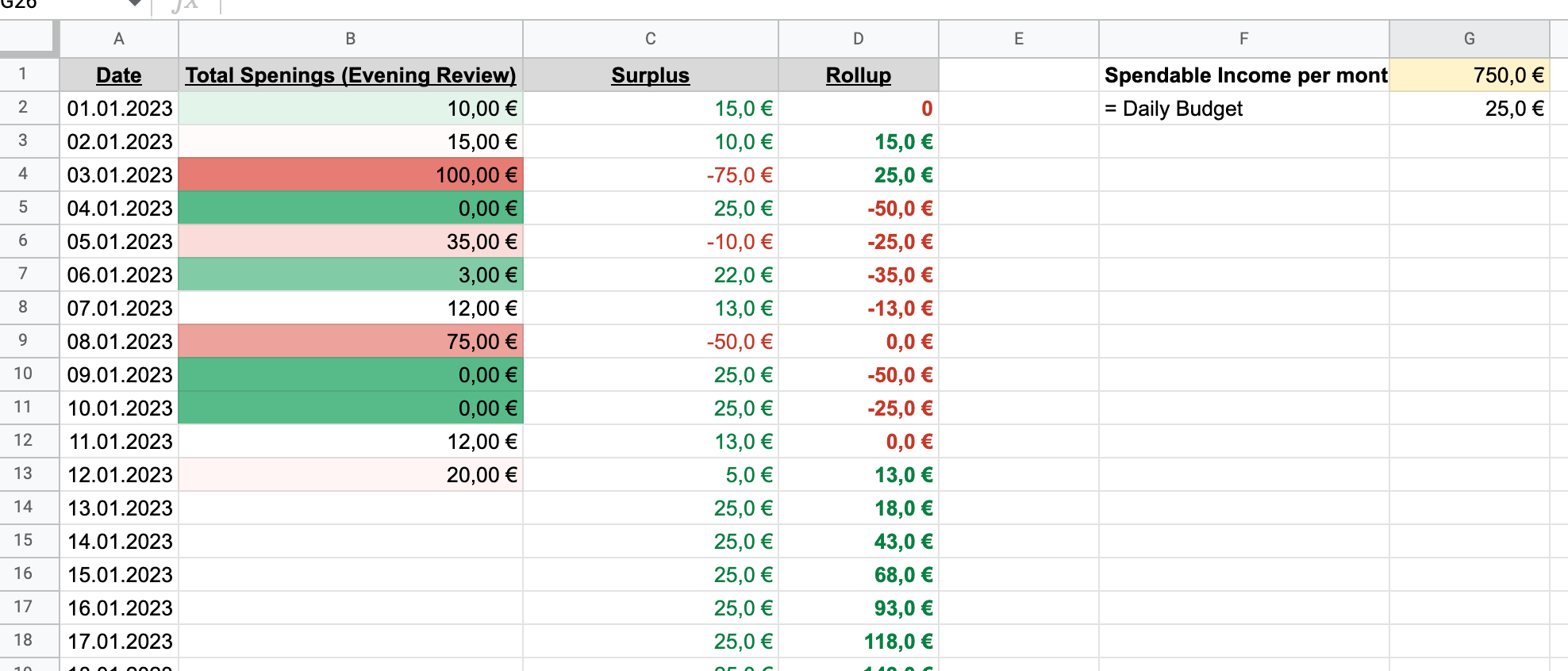

The daily budget approach is simple to implement. All you need to do is set a daily spending limit and track your expenses as they occur. You can use a budgeting app or a simple spreadsheet to record your expenses.

It's essential to keep in mind that a daily budget is not a one-size-fits-all solution. Your daily spending limit will vary depending on your income and lifestyle. It's a good idea to start with a conservative limit and then adjust it as needed.

Benefits of a Daily Budget

The daily budget approach has several benefits:

- Increased spending awareness: By tracking your expenses daily, you'll better understand where your money is going and identify areas where you can cut back.

- Reduced impulse spending: When you know your daily spending limit, you'll be less likely to make impulse purchases.

- Improved financial discipline: By sticking to a daily budget, you'll develop better financial habits and be more mindful of your spending.

- Flexibility: Because a daily budget is based on a daily spending limit, it's easy to adjust as your income or expenses change.

The gamification aspect of this methodology helps me carefully consider spending a large amount of money if doing so would cause my overall balance to drop below zero, based on my virtual "earnings" over the past couple of days."

I may still have to decide on the significant expense that exceeds my daily budget, but then at least it's clear that I have to recoup this within the month. And if I know that more considerable expenses are coming, I try to save something for them at the beginning of the month.

Tips for Success

- Be realistic: Don't set a daily spending limit that's too low. You'll end up feeling restricted and frustrated.

- Be consistent: Track your expenses daily to get the most accurate picture of your spending.

- Be flexible: Adjust your daily spending limit as needed. You may need to increase your limit if you're consistently over budget.

- Be mindful: Be mindful of your spending habits, and try to find ways to reduce expenses without sacrificing your quality of life.

The daily budget approach is a simple and effective way to gain control of your finances. By tracking your expenses daily, you'll be able to identify areas where you can cut back and improve your financial discipline. Give it a try and see how it can help you take control of your spending and reach your financial goals.

Integration proposal into your regular workflow

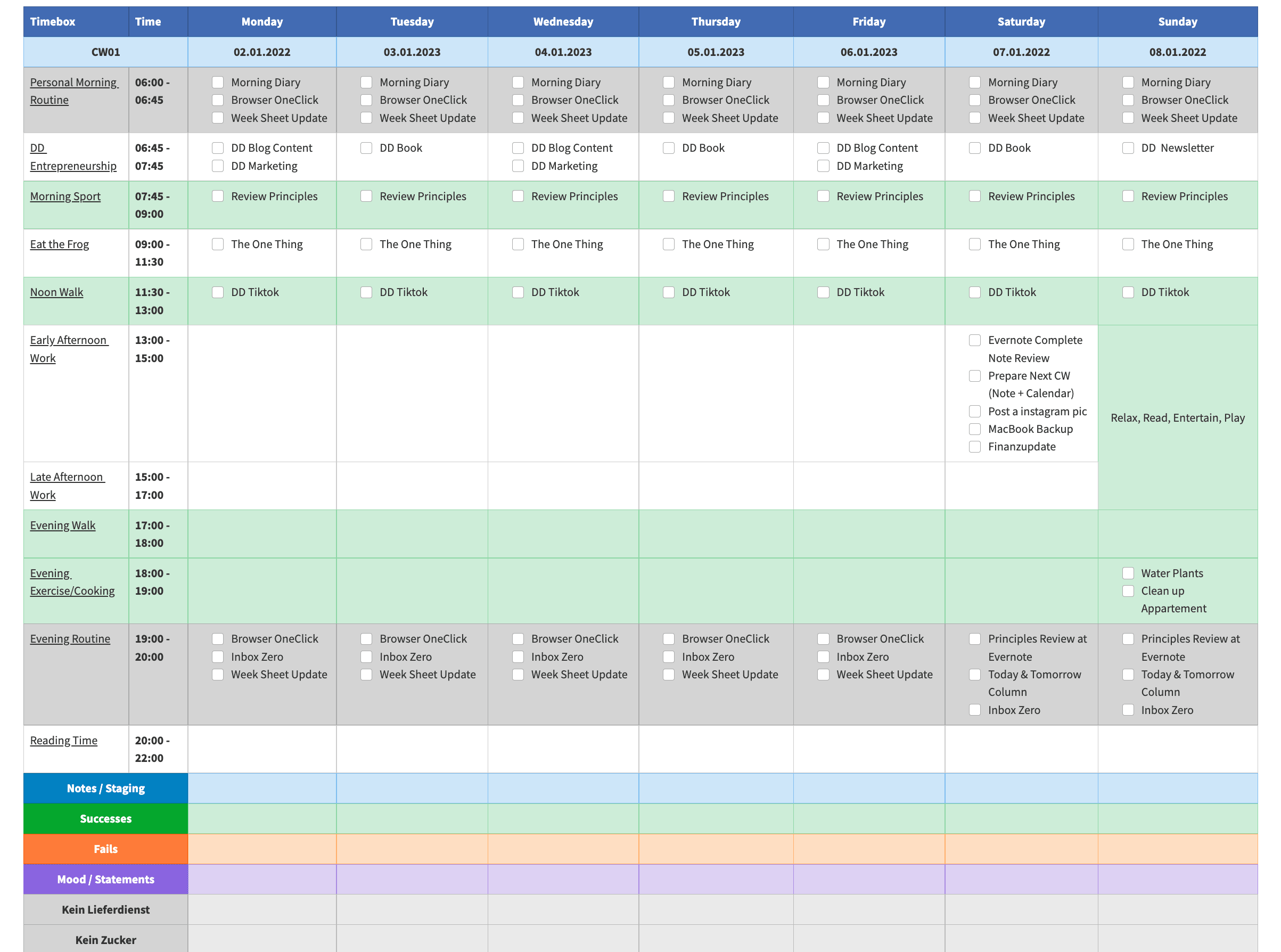

I like combining this daily budgeting approach with the weekly planning I wrote about last week:

As you can see in the article's title image, I plan my week in a spreadsheet where the vertical is my agenda, and the horizontal is the days of the week. Once you have a spreadsheet like that, it's super easy to add another line at the very bottom called "Daily Budget", where you subtract your spending from your daily budget and document the result as a part of your evening routine. This way, you can see whether the week was a net plus or net minus on the spot.

Limits & Considerations

The approach is straightforward, and accordingly, you need to use it carefully:

- Of course, we also have expenses with a planning horizon that goes beyond a week or a month. It would be best if you handled such large expenditures separately and not in the daily budget. Otherwise, the seemingly uncatchable deficit will demotivate you and cause the system to collapse.

- When calculating your Daily Budget, don't go to the upper limit of your income, but think of it more as spending money and from the perspective of "as much as you need, as little as you can". Of course, it must be a realistic value you can manage well over a week and a month.

- Your Daily Budget is calculated by subtracting your monthly and annual fixed expenses, investments, and savings from your monthly income and dividing the result by approximately 30 days.

Also, there are some great apps if you don't like to do it manually in a spreadsheet. For iOS, I can recommend "Daily Budget Original":

Conclusion

A daily budget is a powerful tool that can help simplify your finances, increase your awareness of spending, and reduce unnecessary expenses. It's a simple and effective way to gain control of your finances and reach your financial goals.

Start tracking your costs today and see how a daily budget can help you take control of your spending and improve your economic well-being.

Feel free to add your tips and thoughts to this page's comment section, Twitter or LinkedIn!

Best regards,

-- Martin from Deliberate-Diligence.com

Discussion